Is Zuora a multibagger in the making? - Part 1

- Investing Gurukul

- Jan 14, 2020

- 9 min read

Updated: Jan 16, 2020

Click here to read part 2 of this series:

Zuora Stock Analysis ($ZUO):

As I write this, Dow Jones has hit an all-time high. Tesla has crossed $400. Shopify has crossed $415. Listed SaaS companies continue to reward its shareholders with excellent returns. I am curious about one company in the SaaS space - Zuora which made it's IPO debut in 2018. It priced its IPO at $14. As SaaS stocks continued to remain a crowd favorite, the first trade of Zuora was at $20. Within 2 months of listing, stock price sky rocketed and reached an all time high of $34.63 (150% returns within 2 months). After another 2 months, Zuora's share price started going down. It has gone down so much that it is now available around it's IPO price of $14. What is happening with Zuora? Is Zuora still a good investment at current price levels? Let's have a look.

📷

Zuora offers a subscription billing solution. It helps companies to recognize revenues from customers on a recurring basis. To understand more about the business, consider a platform like Netflix. Netflix is a video streaming platform and it offers different solutions at different price points. For example, if you want to subscribe to Netflix for one month, you can do so by paying $13. In case, if you want to renew services after a month, you can do so by paying another $13 through Netflix’s platform. Netflix offers different pricing models on a subscription basis. It makes regular changes to its pricing plans and also offers discounts.

Zuora is a one stop solution for platforms like Netflix to create pricing plans, discounts, and automate payment collections from customers on a recurring basis during each and every month or quarter. There is a fundamental shift towards this business model as customers these days prefer to pay a small amount on a recurring basis instead of a large transaction.

Zuora is a pioneer and a leader in the subscription billing industry. It is primarily focused on enterprise customers with large ticket sizes. Zuora has a proven track record with 900+ customers across 30+ countries. It has a diversified customer base with clients across different industries like automobile, manufacturing, SaaS, technology, e-Commerce, media, publishing, utility etc.

Industry and its Potential

📷

Subscription billing, as an industry, is still evolving. As of 2019, the market size is $4.4 billion. This industry is expected to grow at a CAGR of 15% from 2019 to 2025 and reach $10 billion. Interestingly, Zuora is the leader in this space. Zuora founders have envisioned a need for subscription billing. They have evangelized this industry. Zuora continues to remain a pioneer and a torch bearer for this nascent industry.

Globally, firms have traditionally followed a fixed price business model as they sign a one time deal with their customers. This trend is slowly changing as companies are moving towards subscription based payment collection method. The impact is not just seen in software but it is clearly visible in other industries like auto, manufacturing, media, telecom, publishing, retail, utility etc. There is also a strong behavioral change in the way customers purchase products. Users subscribe to online magazines, OTT platforms, media streaming etc. on a monthly basis.

Industries are continuously innovating and are looking at new ways to run businesses efficiently. According to Gartner, around 70% of companies in the world are either considering or have already implemented subscription services. Publishing companies have lost offline sales and they are trying to convert online visitors of news articles into paid customers through subscriptions. We have different billing models today such pay as you use, pay on a monthly basis, tiered pricing etc.

Ecommerce companies have conceptualised subscription boxes where customers are provided different experiences every month or provided products every month on a recurring basis. Eg. Dollar Shave Club is a successful company that offers razors in a monthly subscription plan. Auto companies that manufacture luxury cars are slowly moving from traditional one time purchase customers to subscription based customers. Though it started with the technology sector, the scope for subscription billing industry is slowly growing to other industries like e-commerce, media, publishing, automobile, manufacturing, utilities. Let’s look at these industries.

📷

SaaS:

SaaS industry is expected to show robust growth and enterprise cloud spend is expected to grow 8 fold from $100 billion in 2017 to $800 billion in 2027. These are exciting times for SaaS companies as they continue to show strong revenue growth. As SaaS companies run on a subscription model, the need for subscription billing solutions is explicit in this sector. Subscription allows companies to automate payment collections on a recurring basis. There are other critical problems like churn management, revenue tracking, efficient time management, pricing changes, invoices. Hence, SaaS companies get a ready-made solution from companies like Zuora and they can focus on their core problems.

Read more about the SaaS industry: https://www.investinggurukul.com/post/looking-for-the-best-returns-from-mutual-funds-investing-in-public-saas-companies-can-give-you-more

E-commerce:

E-commerce industry has changed the way products are purchased. In e-commerce, customers are slowly shifting towards recurring purchase of online products. They call this subscription e-commerce or subscription box. The total market size for subscription e-commerce industry is estimated at around $15 billion. Since 2014, top 500 US retailers have grown subscription box at a CAGR of around 60%. This shift has resulted in companies like Dollar Shave Club, Stitch Fix growing rapidly (Dollar Shave Club was Zuora’s client till it got acquired). These companies require a subscription billing solution to bill their customers regularly. With subscription box growing, we can expect subscription billing to also grow.

Media & Publishing:

Media and publishing companies live or die today by usage and engagement. As publishing companies lost offline sales, they became one of the first few sectors to embrace the subscription model. These companies are setting goals to increase their digital footprints to bring in more revenues from online subscription. They have been innovating to make customers subscribe to their online portal. Publishers focusing on online subscription models are growing faster than others.

Automobile:

Subscription based business is not just limited to technology and ecommerce. There are other industries that are witnessing a rapid change from a traditional business model to a subscription based business model. Auto sector is one such industry that is taking rapid strides into subscription as customer preferences are changing. Vehicle subscription is helping businesses as well as individual customers as they save huge capital investment upfront. Global automotive subscription services market is expected to grow at a CAGR of 71% between 2018 and 2022. Hence, there is a huge opportunity available in auto industry.

Telecom:

Telecom is one industry that has always managed to collect revenues on a subscription basis. Companies are in need of a subscription billing solution to price products dynamically and charge clients regularly on a monthly, quarterly, yearly basis.

Other key industries such as Banking, Insurance, Health Care, Financials, Manufacturing, Utilities etc. are also shifting to subscriptions. As this shift continues, the market size for subscription billing companies will continue to grow massively.

About the Company:

Zuora was founded in 2007 by former salesforce and webex employees Tien Tzuo, K. V. Rao and Cheng Zou. While working, they felt that subscription billing was a hard problem to solve. They faced issues first hand and decided to launch a subscription billing solution to solve a complex customer problem. Zuora is headquartered in San Mateo, USA. It has 1200+ employees with offices in the USA, UK etc. Zuora serves customers in over 30 countries. It also has offices across different countries in cities like Sydney, Atlanta, Beijing, Boston, London, Paris, Chennai etc.

Zuora CEO:

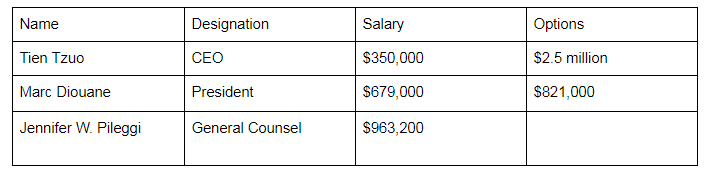

Tien Tzuo is the CEO of Zuora. He was the 11th employee of SalesForce. He became SalesForce’s first chief marketing office and then it’s chief strategy officer. Later, he founded Zuora. He’s evangelised the shift to subscription based business models. He also coined the term ‘Subscription Economy’. In 2018, he launched a book called ‘Subscribed’ which talks about how the world is moving from product based to service based business as customers increasingly prefer access over ownership. He continues to remain a stalwart in the subscription billing space. After Zuora came up with an IPO, Tien’s stake in the company is still a healthy 10%.

Products:

Zuora offers a subscription billing suite which has three different modules:

Zuora Central Platform

Order to Revenue Products

App Marketplace

📷

1. Zuora Central:

Zuora Central Platform is a subscription management hub which helps customers to handle the entire cycle from order to revenues. Merchants can create pricing plans, subscriptions, enable multiple payment gateways. They also offer payment collections through 150+ different currencies and 20+ supported payment methods. Besides these features, they offer key metric based insights through dashboards and reports.

2. Order to Revenue Products:

Zuora also has a portfolio of SaaS products that work on top of the central platform. Billing allows customers to bill in multiple ways, calculate prorations when subscriptions change, and to group customers into batches for different billing and payment operations. RevPro is a revenue recognition automation solution that enables customers to group transactions of goods and services into

revenue contracts and performance obligations in accordance with the new ASC 606 / IFRS 15 revenue standards. While CPQ (Configure Price Quote) allows customers to configure any type of deal, Zuora Collect helps customers to collect pending payments through dunning.

3. App Marketplace:

Zuora marketplace has apps from different third parties and partners. These apps work on top of Zuora’s existing product features. This app store ecosystem is not as robust as a Google Play Store or Shopify App Store.

Competitors:

Companies prefer to use the billing module available in enterprise applications like Oracle, SAP etc. Otherwise, they build an inhouse billing solution. But when complexity increases, there is a need for a separate billing solution to resolve all their requirements. This is where companies like Zuora come into the picture.

In-house Billing Solutions:

Zuora’s key competition comes from homegrown DIY systems. Companies don’t realize that they need a separate billing system to handle recurring revenues and its complexities. Instead, they prefer to build in-house solutions. They spend a lot of time on this instead of focusing on their core product offerings. Hence, Zuora used to educate customers about the need of a separate billing system. Zuora’s problem is not about the opportunity size for their product offerings. Opportunity is there but prospects don’t realize that they need a billing solution like Zuora. This is slowly changing now as companies have started to focus on outsourcing their billing problem. As more and more companies realize this, Zuora will continue to get a lot of prospects.

Enterprise Companies:

📷

According to a Forrestor research report dated Nov 19, 2019, Zuora is ranked as a leader in the SaaS billing solution space. Over the last few years, Zuora has been consistently rated as a leader in different research reports published by top global research companies. According to the report, Zuora has a superior solution when compared to all other competitors. And it also seems to have a stronger strategy in increasing market presence.

Though Zuora is a leader in subscription billing, it faces two way competition. In the enterprise space, traditional ERP solution providers like Oracle, SAP etc. are real competitors. These companies have an add-on billing solution within their product. It is very difficult to crack deals when there are players who provide multiple solutions as a suite. But Zuora scores here by providing a better solution for billing. Since Zuora is focused on subscription billing, it solves the problem better and hence, is preferred by customers who need a subscription billing platform. In the pure billing solution space, Zuora primarily competes with Aria Systems.

SMBs are moving up the value chain:

On the other hand, there are a lot of small players in the market. Even Stripe, a leading payment gateway has launched a billing solution. With a lot of new players in the market, competition is intensifying. But it also validates the fact that there is a huge market and that’s why other companies are also coming up with subscription billing solutions. Some of these small companies have realized that they will not be able to scale up by focusing only on SMB customers.Hence, competitors like Chargify, Recurly, RecVue, Fusebill etc. are adding more features to their products and are trying to convert enterprise customers. They typically quote prices lesser than Zuora’s price.

As these new companies and their products are built recently, they have a user friendly interface which is intuitive and a lot more responsive. Zuora has an age old product with its own set of issues. If these smaller players continue to create impact, then Zuora might not be able to capture all the available market share. But still, Zuora is the leader and it has been able to convert a lot of Fortune 500 companies as it’s customers.

Strong Enterprise Clients:

📷

📷

Recently, Zuora signed Kia, Chrysler, Harley Davidson. In the utility space, they converted large customers like Saint Gobain, Origin Energy, Sanan, A2A, Centrica. These client names speak volumes about Zuora’s superiority in the subscription billing space. The list also includes marquee names like Caterpillar, Schneider Electric, Zoom, HBO, AT&T, Toyota, Box, DocuSign, WallStreet Journal, Zendesk. Hence, we can expect Zuora to own this space as a leader and continue to show robust growth. Click here for Part 2 - Zuora's Valuation

Click here for part 2 - Zuora's Valuation

Comments